Creating a budget can be a daunting task. It takes some upfront effort, and continual tweaks and maintenance to keep going. Is it worth it? Absolutely. In this post I will cover the first step in creating a budget - tracking your expenses. Even if you don’t want to create a budget, tracking your expenses can go a long way to help you understand your financial situation. Sometimes just tracking your expenses is all you need at the moment.

A Financial Snapshot

First, you will need to create a financial snapshot, which means writing down all of your income and your expenses for a period of time. You could do this for a couple weeks, or a month, a year, or anything in between - it is up to you. At the very least you need to look at a time span that will match the period of your budget. So for example if you want to create a monthly budget, then you should track your expenses for at least a month (but preferably multiple consecutive months). The more history you have the more accurate and practical your estimations in your budget can be.

In my examples I will be using the free gnucash accounting software. If you would like to follow along with gnucash, create a new file now and start with a completly clean slate (do not auto-setup accounts). We will setup the appropriate accounts as we go.

Let’s assume we are tracking our monthly expenses. We will list every single expense (whether paid by debit, credit, cash, direct bill payment, etc) for the month, and categorize the the way we choose.

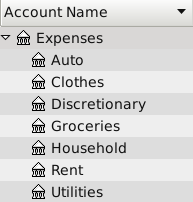

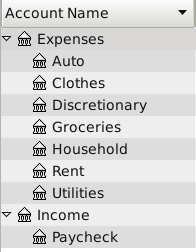

In gnucash, you can add an expense category by going to Actions->New Account, and selecting an Account Type of ‘Expense’. Make sure to also add a name to the account, and the parent account (the top level account should simply be ‘Expenses’).

Expense Categorization

This part may seem simple at first, but it could possibly require some thinking. Obviously you may categorize your expenses the way you feel, but in general no categorization (listing all expenses as ‘expenses’) doesn’t work because then we don’t know what we’re spending our money on. On the flip side, creating a category for every item we buy generally requires too much time to record. So a nice middle ground is warranted. Also, auto-categorization with accounting software could be really useful here if it is available to you.

For this part, I categorized my expenses based on how I will be allocating funds in my future budget. I will be using the envelope budgeting system, which means that I will be allocating a specific amount of money each month for each category. By using the same categories for your envelopes and your expenses, it is easy to make estimations when you set up your budget, and it is easy to track both our envelopes and our expenses once we get the full budget up and running. This part will make more sense when we start thinking about our budget allocations.

Entering Expenses

gnucash is a double entry type of accounting software, meaning that each transaction that you enter must be recorded in at least two accounts. Practically speaking, you can think of this as money must come from somewhere (i.e. an asset like a bank account) and it must go somewhere (i.e. an expense, like groceries). For now, we will have two basic types of parent accounts - an expense account (as we just setup), and an income account. Let’s setup the income account now, and add a sub-account called ‘Paycheck’. In gnucash, make sure to select an account type of ‘Income’ (this ensures that the column header names in each of the account ledgers has appropriate names).

Now, open up the ‘Paycheck’ account. Let’s add an example transaction. More on the next entry.